OUR APPROACH

Thesis-Driven.

Disciplined Methodology.

Deep Sector Focus

We focus on the Aerospace & Defense and Industrial Technology & Services industries based on a thesis-driven investment methodology which identifies long-term macro and secular growth trends. We believe our phased approach allows us to expertly investigate, deploy, and execute against these investment theses.

Aerospace & Defense

McNally Capital values the Aerospace & Defense sector due to its mission-critical nature, high barriers to entry, and industry tailwinds with long-term demand drivers. In our experience, these factors create sustained growth opportunities.

-

In our view, what differentiates McNally is our access to elite customers in the intelligence community and U.S. government. We believe our proven track record and innovative approach help us achieve our goals of delivering strong value and strategic partnerships in this space.

-

Sub-sectors where we see the greatest opportunities include:

Aerospace Platforms & Components

Aerospace Support & Services

National Security Defense Technology

National Security Government Services

-

Airforce Turbine System (“ATS”)

Quiet Professionals

Xcelerate Solutions

Orbis

FedData

Altamira (realized)

Genesys Aerosystems (realized)

Industrial Technology & Services

McNally Capital sees strong potential in the Industrial Technology & Services sector due to its mission-critical role in addressing U.S. geopolitical and labor challenges. The industry is at an inflection point where we believe technological innovation can drive significant impact.

-

In our view, what differentiates McNally is our strong network and proven success in the lower middle market (LMM) and our ability to institutionalize business operations for scalable growth.

-

Sub-sectors where we see the greatest opportunities include:

Industrial Technology

Industrial Automation

Industrial & Commercial Services

-

Foundral

Jewett Automation

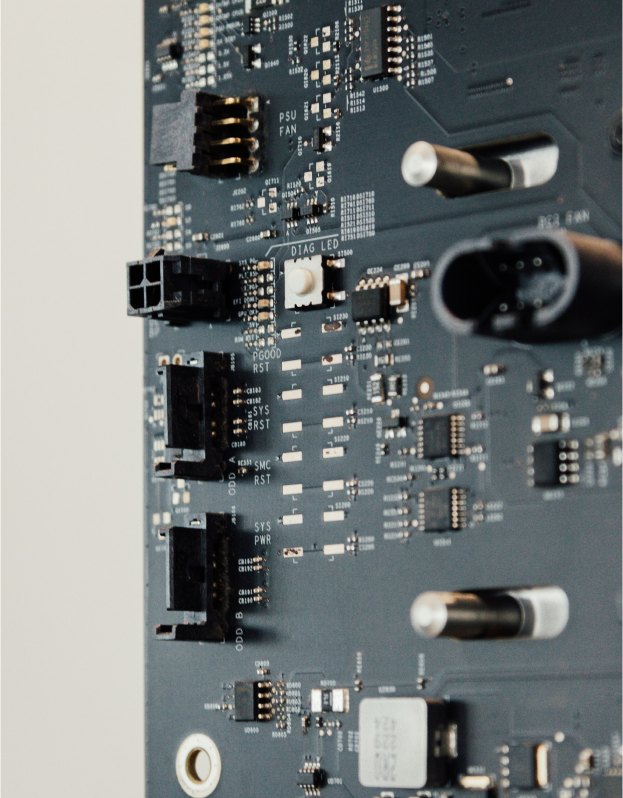

Dedicated Computing

Advanced Micro Instruments Inc. (realized)

ITS Logistics (realized)

Re-sourcing (realized)

Europa (realized)

Investment Criteria

Parameters

$5-30M EBITDA

$15-65M Equity

Majority equity stake

Company Attributes

U.S. / Canada-based

Strong management team willing to stay & invest in the business